Cftc Vs Sec Jurisdiction On Cryptocurrencies

The CFTC looks beyond form and considers the actual substance and purpose of an activity whe n. One hearing between the SEC and the CFTC concluded as the latter commended the former on their creation of an evolving paradigm for cryptocurrencies being traded.

The Impact Of Cryptocurrencies On The World Economy

There is no inconsistency between the SECs analysis and the CFTCs determination that virtual currencies are commodities and that virtual tokens may be commodities or derivatives contracts depending on the particular facts and circumstances.

Cftc vs sec jurisdiction on cryptocurrencies. SEC Commodity Futures Trading Commission CFTC to implement the regulatory framework for. The regulatory landscape surrounding cryptocurrency continues to evolve. However we can say that in accordance with the US Code Title VII and XV the CFTC regulates investments in commodities to be delivered in the future while the SEC.

On a related note the premier sates that there is no inconsistency between the CFTCs definition of virtual currencies as commodities and the SECs determination that cryptocurrencies and its related ICOs are categorized as securities. SEC Chairman Jay Clayton has said before that cryptocurrencies and ICOs may be considered as securities and will therefore be subject to SEC regulations. We said earlier that statutory definitions will help clarify this matter but it doesnt seem to be the case.

Today the SEC chairman Jay Clayton and CFTC. The Chairman Giancarlo also noted that the CFTC has been working closely with the SEC in making policy and jurisdictional decisions29 2. The matrix below summarizes key issues raised as a result of differences between the rules adopted or proposed by the Securities and Exchange Commission and the.

SEC vs CFTC. CFTC Jurisdiction Over Cryptocurrency Implications for Industry Participants. Early Regulatory Action Both the Securities and Exchange Commission SEC and CFTC have taken steps to regulate fraud in the emerging cryptocur-24 Id.

And the confusion does not end there. Second before arriving at its conclusion that the CFTC. Lately the CFTC has brought cases against individuals and entities that make false representations regarding cryptocurrency trading expertise and activity.

The CEAs fraud rule was modeled after Section 10b and Rule 10b-5 of the Securities. Most of the activity to date has involved regulatory enforcement actions brought by the Securities and Exchange Commission SEC and Commodity Futures Trading Commission CFTC and focused primarily on exposing fraud rather than providing guidance. Although Bitcoin and Ethereum fall under the CFTCs purview the SEC is still controlling the larger initial coin offering ICO market.

CFTC Jurisdiction Over Cryptocurrency. The CEAs misrepresentation rule was designed according to Section. The ramification for Industry participators.

The agency stressed however that the best approach to regulating cryptocurrencies on the blockchain needs to be one that allows for maximum growth and innovation in the developing industry. Whether this means the Securities and Exchange Commission or SEC will refrain from asserting jurisdiction as a hybrid security remains to be seen. A turf war is also going on between the two regulators for the control of the cryptocurrency market.

CFTC has exclusive jurisdiction over cryptocurrency futures markets. Securities and Exchange Commission SEC and Brian Quintenz Commissioner at the US. Executive summary The SECs Peirce noted that in the past the SEC has given the green light for Exchange.

Must a cryptocurrency fund register with the CFTC. In this case the CFTC has been pretty clear they will get involved as has recently been both stated by the head of the CFTC and supported by a September court ruling where the CFTC was pursuing charges against a cryptocurrency they claimed was a fraud. 27 Virtual Currencies supra note 17 at 103.

Summary of SEC and CFTCs testimony on blockchain cryptocurrencies. Last week Hester Peirce Commissioner at the US. 11 Fincen issued a joint statement with the SEC and the CFTC to remind anyone engaged in crypto activities of their AML and CFT obligations under.

Feb 6 2018 4 min read. Apart from the CFTC claiming jurisdiction over cryptocurrencies saying they are commodities and the SEC saying they are securities the Internal Revenue Service IRS says they are to be. The most common questions we hear from startup cryptocurrency fund managers involve the regulatory requirements of imposed on cryptocurrency funds by the Commodities Futures Trading Commission CFTC and the Securities Exchange Commission SEC.

Must a cryptocurrency fund register with the SEC as an RIA or otherwise comply with state investment advisor regulation. Key Issues under Title VII of the Dodd-Frank Act. Commodity Futures Trading Commission CFTC talked about blockchain and cryptocurrencies at a Bipartisan Policy Center event.

For example the CFTC on October 16 2019 charged a Nevada company with fraudulently soliciting 11 million worth of Bitcoin and cash as part of a Ponzi-like scheme that included misrepresentations of trading expertise and.

Jpmorgan Decrypting Cryptocurrencies Technology Applications And Challenges Cryptocurrency Bitcoin

Cryptocurrency Money Laundering Explained Bitquery

Pdf To The Moon Defining And Detecting Cryptocurrency Pump And Dumps

Cryptocurrency Exchange Binance Announced On Monday Its New Open Blockchain Project Called Venus According To Bina Cryptocurrency Blockchain Gold Investments

Bitcoin Price Tanks Amid Sec And Cftc Crackdown On Cryptocurrencies

Pdf The Anatomy Of A Cryptocurrency Pump And Dump Scheme

The Ongoing Evolution Of Cryptocurrency Regulation And Litigation Analysis Group

Blockchain Laws And Regulations Usa Gli

Pdf Cryptocurrencies Are Disruptive Financial Innovations Here

Pdf Cryptocurrencies Legal Regulation

Blockchain Cryptocurrency Regulations In Us Abroad

Investment Report What You Should Know About Cryptocurrencies Moneta Fee Only Financial Planning Investment Advisors Clients Nationwide

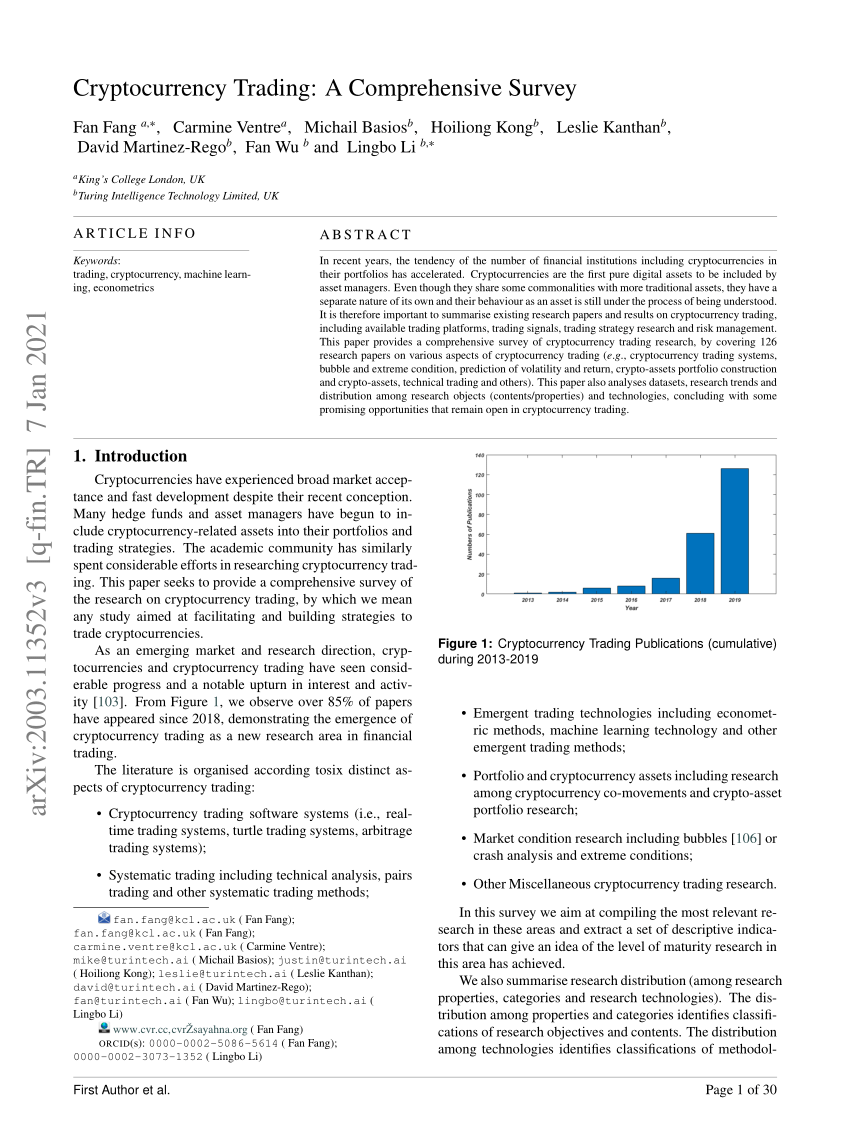

Pdf Cryptocurrency Trading A Comprehensive Survey

Pdf Theoretical And Legal Perspective Of Civil Liability In Cryptocurrency Relations

Top Crypto Trends For 2021 Primexbt

Week 7 Legal Issues In Blockchain And Cryptocurrencies

Pdf Blockchains And Bitcoin Regulatory Responses To Cryptocurrencies

Global Cryptocurrency Market Report By Ibinex By Erica Brown Issuu